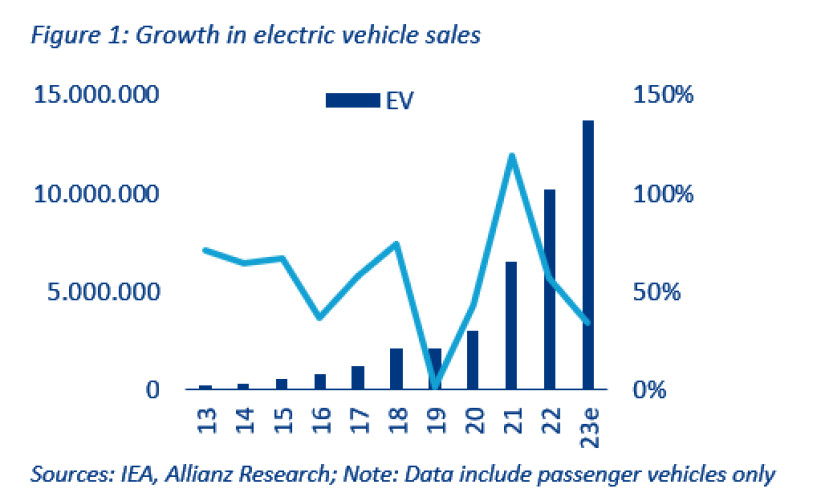

Additionally, resilient economic growth and strong, albeit slowing, growth in EVs fueled car sales – total global auto registrations increased by +11.3% to nearly 88 million, though is still below pre-pandemic levels. The three largest auto markets – China, the US and Europe – all recorded strong growth in 2023, at +11.9%, +12.5% and +17.2% respectively.

Geopolitical tensions could also hit overall demand with the prospect of higher tariffs. But EVs still remain in a relative sweet spot despite major headwinds. According to Allianz Trade forecasts the sale of new EV passenger cars to exceed 18 million (+32.8% y/y) in 2024, with Europe leading the way (+41.2%). On the production side, analysts anticipate a decline in gross and EBIT margins to 18.7% (-28pps). The industry is poised to see a rise in intra-regional collaboration among automakers and stakeholders across the supply chain to gain an edge in the reshuffling.

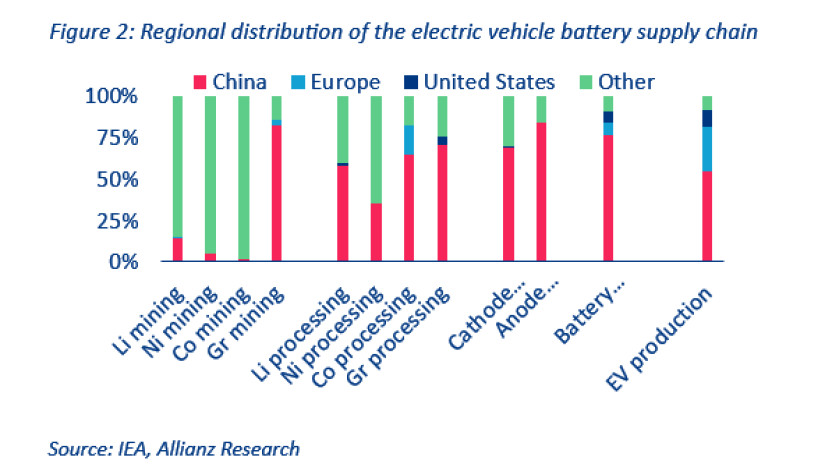

The auto industry has been the backbone of the European economy, not only driving industrial innovation and technological advancements but also creating substantial employment opportunities. To meet ambitious climate targets and achieve carbon neutrality, governments around the world are actively promoting green energy over fossil fuels. So industry will play a central role in this transition and will depend on increasing the number of electric cars. In this context, the defining attribute of a car is gradually starting to shift from engine capability - an area where European, American, Japanese and South Korean carmakers have excelled in the ICE era - to battery and software capabilities. Regionally, the shift has already begun, and China remains a disruptive factor, challenging traditional auto leaders with its decade-plus of investment in software capabilities. China is also redefining the global automotive landscape with its rapid development of electric vehicles and dominance of the entire supply chain.

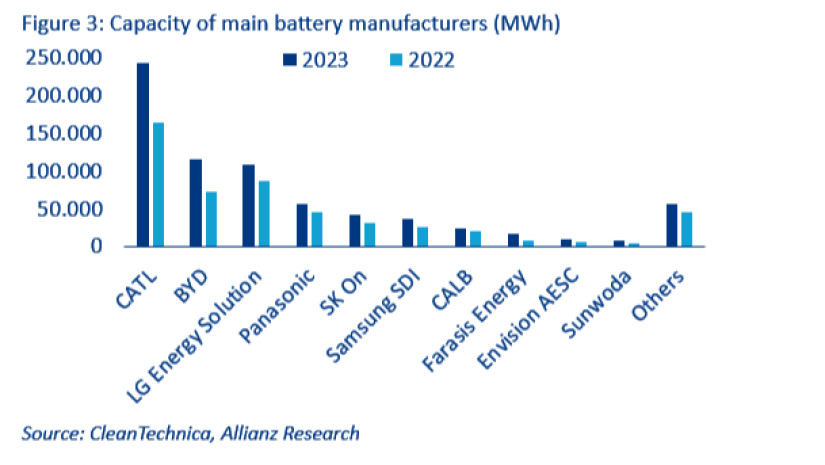

Amid elevated geopolitical tensions, Europe and the US are growing increasingly wary of their dependence on Chinese supplies, as well as the impact of the growing popularity of Chinese EVs on their local industries. Six of the top 10 global manufacturers of batteries are based in China, with the remaining four also in Asia, together accounting for 92.1% of the world's total battery capacity installation in 2023. Governments have started to impose restrictions and strictly supervise auto imports from China. The US offers up to $7,500 in tax credits for the purchase of new EVs but excludes those with Chinese components. Since Chinese companies can produce EVs at much lower cost, thanks to the well-established local supply chain, cheaper labor costs and scale economies, the influx of cheaper Chinese EVs could bridge the gap in the lack of mass-market models in the West, thus accelerating the EV transition. But policymakers face a dilemma between going green cheaper and quicker and the risks this poses to local industries and employment, adding to the uncertainty.

European automakers are losing ground

The auto industry has been the backbone of the European economy, not only driving industrial innovation and technological advancements but also creating substantial employment opportunities. The EU auto sector contributes to around 6% of the region's output, accounts for close to 950,000 firms and employs 6.5 million people. Some estimates that include indirect jobs count as much as 13mn people, which would represent 7% of total employment in the EU. The sector also serves as an innovation hub as the EU's largest investor in research and development, contributing 32% to the region's annual R&D investment (nearly €73 billion in 2022). Additionally, the auto sector also plays a crucial role in the region's export market as European, especially German, carmakers have been renowned for their engineering prowess, design and performance.

Last year, the trend of accelerated growth in sales of electrified cars (including full hybrids) continued in Romania, with market share reaching about 24% of the total, 11% more than diesel models. If we isolate the analysis to "full electric" cars only, the advance is moderate, the latter reaching a market share of 10.7% in 2023 compared to 9.1% in the previous year.

"The decreases reported in March and in the first quarter of this year, both for electric cars and overall, could compromise estimates for growth in new car sales for the full year. Thus, initial expectations of more than 20% growth in "full electric" car sales could face an unpleasant surprise in 2024 if several factors are taken into account. In addition to moderated consumption by inflation and high interest rates, there are other factors with a major impact such as decreasing grants for electric cars and lack of charging infrastructure. Looking ahead, beyond volatility on a quarterly or yearly basis, sales of electric cars and the local car industry in general could advance at a slow pace in the coming years in the absence of a development strategy for this sector. The production of electric cars depends on the availability of batteries, software and related electronics - elements that influence the cost of production. Furthermore, the attraction of investment in building battery factories is far from over and should not be linked only to the reduced availability of lithium resources as new technologies emerge. A sustained effort by the State to capture the interest of potential investors for the development of such technologies would ensure the sustainability of the local industry for the coming years.", says Mihai Chipirliu, CFA - Risk Director, Allianz Trade

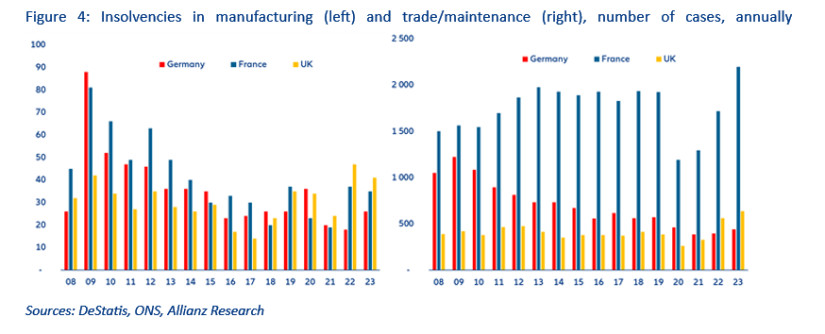

Germany clearly dominates the sector in the EU. However, having long focused on their established strengths, European auto incumbents arrived late to the EV game and are struggling to produce affordable models profitably. Though car makers are racing to cut their costs, elevated energy and labor costs have made it difficult to maintain profitability while selling at affordable prices. Consequently, European carmakers have focused predominantly on the premium segment, leading to a lack of affordable models in the market. The average price of EVs in Europe was €55,821 in 2022 – 27% higher than that of gasoline cars – and almost all EV offerings were priced above €20,000. In comparison, EVs cost €31,829 on average in China, a third lower than the price of gasoline cars in 2022. While grappling with the high costs and low profitability of EVs, European automakers are also facing potential profitability squeezes on ICE vehicles. Last year, the EU reached a provisional agreement on Euro 7, an updated regulation to include additional rules for vehicle emissions and impose stricter requirements for vehicle lifetimes. The new legislation is estimated to increase the direct cost by €2,000 per ICE car/van.

In addition, Europe, particularly Germany, is facing significant challenges in retaining investment within the region amid growing protectionism. The US is emerging as a highly attractive investment destination for European companies, driven by generous federal tax credits and state subsidies. This impact is especially pronounced among German companies, which committed a record $15.7 billion to US projects in 2023, nearly double the amount from 2022.

Meanwhile, the gap between inbound and outbound investment has widened, reaching a record high in 2022, with more than $135 billion in foreign direct investment leaving Germany and only $10.5 billion entering. The auto sector is emblematic of this trend as Volkswagen, Mercedes-Benz and ZF Friedrichshafen spearheaded the three largest US projects by German companies in 2023. Their combined investment totals $4.4 billion and is expected to create 6,300 jobs. Notably, Volkswagen earlier decided to prioritize a battery plant in North America over a previously planned facility in Eastern Europe, enticed by the prospect of receiving up to $10 billion in US incentives. This trend is likely to continue given the high production costs, shortage of skilled labor and lack of comparable incentives in the EU. According to a survey by the German American Chambers of Commerce, 96% of German companies in the US plan to expand their investments by 2026.

Consequently, European automakers are experiencing a notable decline in market share in their home turf, a trend largely attributed to China's evolving role from a major importer to a formidable competitor. This shift is particularly impactful for some of Europe's most renowned automakers that have traditionally depended on the Chinese market for a significant portion of their sales and profits. As a result, European brands are losing ground in both the EU and China, with their market share decreasing by 3.6pps and 4.5pps, respectively, between 2019 and 2022. These decreases correspond with the rise of Chinese automakers, which have not only solidified their position in the domestic market – where there is a growing preference for local brands – but have also made significant inroads into Europe, bolstered by their EV offerings.

To catch up in the new race and boost market uptake, Europe should provide more carrots than sticks. Among the three largest auto markets, the EU has set the most ambitious emissions-reduction goal by effectively banning the sale of new fossil-fuel vehicles by 2035. However, in comparison to the US and China, the EU's approach lacks coordinated support and a comprehensive strategy. By mid-2023, 20 EU countries did not provide any infrastructure incentives and seven offered no subsidies for EV purchases. Incentives are scaling back even further entering into 2024, with Germany terminating the handouts earlier than originally planned and France curbing subsidies due to budget constraints.

The availability of charging stations, which is crucial to address EV buyers' range anxiety, is uneven within the region, with 60% of all charging stations concentrated in the Netherlands (149,025), Germany (125,997) and France (124,526). Policy makers should step up their support for the expansion of charging networks and provide more incentives to encourage the switch to EVs. Furthermore, keeping an edge in the EV competition is more than just expertise in car manufacturing. It also requires a robust supply chain as well as advancements in battery and software technology, which are crucial for managing costs and enhancing driving performance and experience. Hence policy makers should take actions to attract investments across the entire supply chain, ensuring access to essential raw materials, improving refinery infrastructure and advancing battery technology to navigate the crossroads.

The car price war initiated in 2023 – particularly harsh for the Asian EV market – is expected to continue in 2024. How long it will last, and which players will come out relatively unscathed, will depend on the breakeven point. Companies that can diminish their costs as much as possible while still creating profit will gain the most market share through lowering prices. In this regard, Asian automakers are better positioned as they have a historical net profit margin of 7.0% (against 6.2% for US players and 4.7% for Western Europe). While shipping rates of bulkers and containerships have declined significantly from the highs observed in 2021-2022, roll-on roll-off (RoRo) vessel rates have continued to climb, reaching a never-before-seen level of around $115,000 per day.

As of today, 57% of the global RoRo shipping capacity belongs to Asian companies, notably those from Japan (41%) and South Korea (14%), versus only 2% for China. But Chinese OEMs know that in order to further expand into overseas markets they have to fully enter into the RoRo business. Fortunately for them, China dominates global ship construction, responsible for manufacturing 45% of all vessels currently navigating the oceans. In this context, regions less dependent on imported vehicles are likely to witness a fiercer price war as car manufacturers do not have to pass on or absorb higher transport costs. The cost of Chinese cars could be driven down further, given that about 95% of vehicles sold are made locally. In Europe, only 75% of vehicles sold last year were made locally and 25% were imported, of which 48% came from East Asia (China, South Korea and Japan), 15% from Turkey, 11% from Morocco and 27% from the rest of the world.