Luxury goods sales in Europe increased by 4% in 2024, compared to 2023, a slower pace than the 7% and 23% growth rates of 2023 and 2022 respectively. This slowdown indicates a normalisation of the market after the period of accelerated growth.

In 2024, fewer new stores opened (83) on major European shopping streets, compared to 107 in 2023, with Paris, Milan, and London remaining the main luxury markets.

In Central and South-Eastern Europe, Prague stood out with the opening of 5 luxury stores in 2024. In Romania, Calea Victoriei has the potential to become an important destination for luxury brands, considering the investments in the renovation of historical buildings.

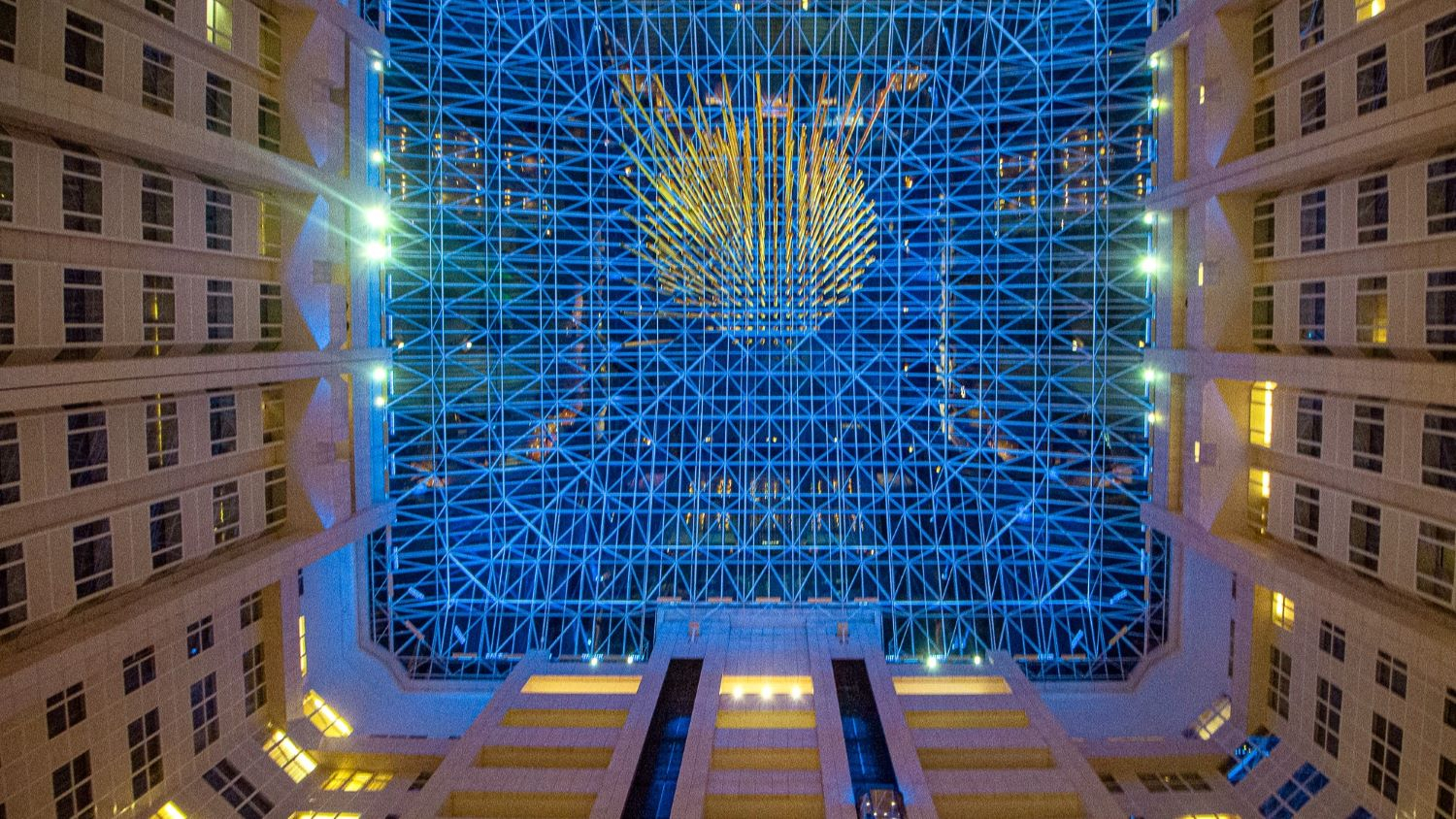

Brands such as Louis Vuitton and Zegna have already opened stores in prime locations in this area. Other brands such as Dior, Hermès, Chanel, and Guerlain are expected to join them, following the renovation of the Știrbei Palace by Hagag Development Europe.

Raluca Zlate, Senior Consultant Retail Agency at Cushman & Wakefield Echinox, said: “Analysis of the performance trends of the main luxury brands present in Romania shows that between 2019 and 2023, their combined sales increased by 120%, despite the fact that new store openings during this period were not significant. However, the market is far from reaching its potential, and creating a favourable environment for the development of these brands is essential to attract new names to the market. We are referring here to modern retail spaces, but adapted to the requirements of luxury retail operators.”

The limited availability of premium retail spaces has slowed the pace of new store openings at the European level, and on major luxury streets, the vacancy rate has fallen below 5%.