DN Agrar obtains maximum score in Vextor by ARIR 2024 evaluation

On February 2nd, the company marked three years since its listing on the AeRO market of the Bucharest Stock Exchange.

On February 2nd, the company marked three years since its listing on the AeRO market of the Bucharest Stock Exchange.

A divergence in monetary policy between the ECB and the US Federal Reserve could have significant ramifications for capital flows.

Romanian investors are keeping Tesla in first place in the most-held stocks standings.

Investors are anxiously eyeing the tariff-related decisions Donald Trump may make once he reaches the Oval Office in the White House.

Bringing forward the timetable for elimination of tax facilities for the IT industry, starting January 2025, is a deeply negative signal towards a strategic sector of the economy.

Freedom24 is the European subsidiary of the NASDAQ-listed Freedom Holding Corp, an international investment group with expertise in the USA, Europe and Central Asia.

At the global level, the survey shows that the possibility of a recession for the global economy is the top concern for retail investors (23%) closely followed by inflation (22%).

The funds raised will help finance sustainable projects in line with the eligibility criteria of the Sustainable Financing Framework.

The number of investors in investment funds also crossed the 700,000 threshold, an advance of more than 37% since mid-2023 and 8.6% since the first quarter of this year.

The first stage of the share capital increase will start on August 19th and will last for 32 calendar days, until September 19th.

Since its launch in March 2023, the revolutionary investment platform has successfully tokenized 101 premium real estate assets with a combined investment value of $20 million.

And a new class of information providers is making its way toward the mind of retail investors: the financial influencers, who are active on platforms like Tik Tok or Instagram.

Romanian Association for Investor Relations, the promoter of the Investor Relations (IR) concept, announces that Bento - 2B Intelligent Soft, becomes an Associate Member of ARIR.

Environmental, social, and governance (ESG) principles are no longer just a trend or a buzzword, but rather becoming the norm in the Romanian real estate market.

The number of investors in the fund also increased more than 12 times in these three years, from 1,483 at the end of February 2021 to 18,265 in February 2024.

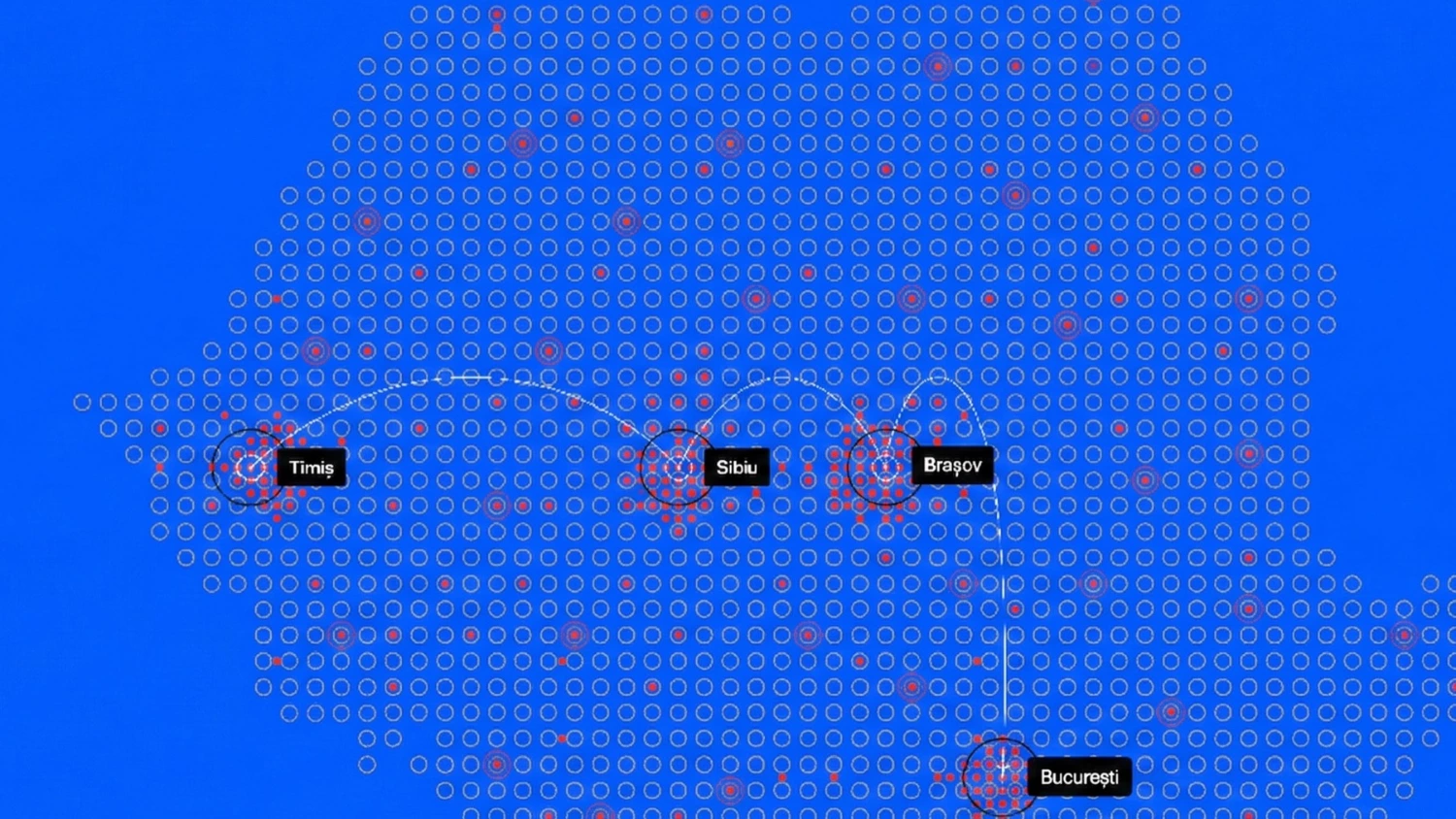

Romania's Government Private Cloud, the country's largest critical digital infrastructure, has entered operational stage nationwide.

Robert Anghel has taken over leadership of Salt Bank, replacing Gabriela Nistor remains close to Salt as a Board Member.

Romania has recorded one of the highest gender employment gaps in the European Union, significantly trailing the bloc's average, according to the latest data from Eurostat.

The latest escalation involving Iran has shifted markets away from “pure macro” indicators—rates, inflation and growth—and back toward geopolitics as a primary driver, according to an analysis by Freedom24.

Romanian deep-tech company Qognifly has launched Drone Wall, an autonomous counter-drone system developed by Romanian engineers and validated in operational conditions.